Initial thoughts

Initial thoughts

There are times when you feel that you have found a company that might become something big. You make your analysis and go over it again and again. You scrutinize the company’s strengths and weaknesses and look at the threats and opportunities. Sometimes the company succeeds but sometimes it just turns out to give you an acing headache. I have been through both and although it’s easy to say that I have learned from my misstakes it’s far from true. The stock market is impossible to predict and can fool you in so many different ways. So when you read this make sure to make your own conclusions and read even more about the company before you decide what to do.

Introduction

Today, I have the same feeling that I had approximately nine years ago when I found G5 Entertainment. I bought the stock for under 10 SEK and sold my last stock for around 200 SEK. The company that makes my senses go sky high like nine years ago today is Nustay. Nustay is an online hotel booking service that operates worldwide and is listed on the spotlight stock market since March this year. The company was founded in 2014 by the Danish entrepreneur Mathias Lundoe Nielsen. Mathias made it his task to develop an online booking platform that would give the customer the advantage and not the hotel booking sites. The customer should get what he or she want and get it to the best possible price.

**Investment Case **

I see Nustay as a growth case that could grow exponentially. The company’s goal is to grow with two digit numbers every month this year and so far the numbers presented by the company and the search engine statistics look very promising.

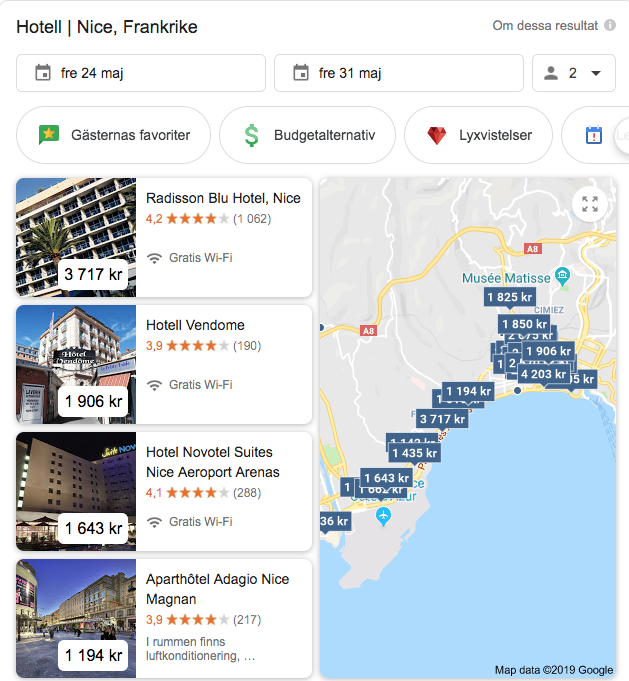

Last year Nustay’s product was ready to launch and what a start it has had. In November 2018 Nustay was the only SMB in the world selected by the giant Google to be a part of their Beta launch of Google Hotel Ads. Google Hotel Ads is Google´s search product for travelers who want to find and book hotels. Google Hotel Ads helps travelers evaluate pricing, availability, booking options and more. It is comparable with Pricerunner that compares prices on products in the market but instead Google Hotel Ads compares hotels. When you google for hotels in different cities all over the world Google Hotel Ads shows you the best deals for hotels in that city. You can read more about Google Hotel Ads here: https://blog.netaffinity.com/everything-about-google-hotel-ads/

Picture shows Google Hotel Ads

This has been a major success for Google and has begun the change of the hotel booking industry. As an accredited firm on Google Hotel Ads Nustay.com can now show their supply of hotel rooms on Google Hotel Ads. The price of being shown there is much lower then making regular marketing on Google and it is very hard to get accredited. This means that a small company like Nustay with a relatively small budget can compete with the industry leaders like Bookings and Expedia. The hotel booking industry has recognized this and now Nustay has been able to sign deals with the other big search engines in the world like Bing, Yahoo and Yandex Hotel Ads. These are still in Alpha (according to Nustay), this means that Nustay is among the very first websites in the world to be approved there. It will most likely take 1-2 years before the Alpha moves into Beta, giving Nustay a solid head start before additional companies can get approved. They are going live on these search engines soon according to Nustay. Furthermore, Nustay has signed deals with meta search firms like Tripadvisor, Trivago, Kayak, Hotelscombined where they will go live later this year.

Picture shows results after clicking on the hotel in Google Hotel Ads

The launch on Google Hotel Ads has made Nustay sales sky rocket and the q1-sales figures where up 470% compared to q1 in 2018 and 170% compared to q4 in 2018 (https://mfn.se/cis/a/nustay/nustay-significantly-increases-its-handled-revenue-by-470-in-q1-2019-d9ee24c9). This is only the beginning of their growth stage and the beginning of q2 shows very promising results when I look at different search engines stats sites. I use Alexa.com and similarweb.com for following Nustay’s stats and as you can see in these links the searches are growing rapidly. Nustays 3 biggest sites on Alexa here:

https://www.alexa.com/siteinfo/nustay.com

https://www.alexa.com/siteinfo/nustay.co.uk

https://www.alexa.com/siteinfo/nustay.fr

And search traffic from similarweb here:

https://www.similarweb.com/website/nustay.com

https://www.similarweb.com/website/nustay.co.uk

https://www.similarweb.com/website/nustay.fr#overview

Keep in mind that the company’s largest market is the US and in February US revenues stod for approximately 50 % of total revenues according to the company presentation. So far Nustay’s platform has been translated to 11 languages and more is still to come.

**People **

When I make an analysis of a company the most important aspect are the people involved in the company. They are the one’s that will make the company grow. They are the ones that will sign deals, handle customers and make continuous improvements. The importance of people for small-business success is just crucial. Right now I think Nustay has an exceptionally strong and diversified team of people. The customer service people that are situated in Ukraine always seem to be very helpful to the customers. How do I know that you might ask? Well, Nustay has a very open minded setting towards customers and you can find a lot of comments from customers on trustpilot( https://www.trustpilot.com/review/nustay.com). Right now the company has a high score on trustpilot but the most important thing is that they help customers that aren’t satisfied with their experience. I can see that from reading the company’s answers to the customers that aren’t satisfied with their experience. The most important thing for a customer that’s not satisfied is to get treated well and get help and thats exactly what nustay´s customer service is doing right now. If we look at people in the board and management they have extensive knowledge and a broad background.

- Nustay’s founder and CEO has founded five e-commerce companies in the past.

- Nustay’s chairman is also active on the boards of e.g. Volvo Cars and IKEA and Nustay’s

- Chief Marketing Officer has been Head of Online Marketing at Momondo for six years.

- Head of IT is a very experienced programmer and software architect who has previously been CTO at Betlab and Intellisoft and has also been a software architect at Luxoft.

- The CFO has extensive experience from the financial industry, in positions such as VP Finance at Pandora Asia, Senior Manager at EY and FP&A Leader EMEA at FMC Corporation.

Product

To get a sense of a company’s product is also a very important aspect for future potential. It’s important to know what’s being sold and its key marketing characteristics, including pricing, packaging and targeting.

Nustay’s product is to deliver personalized hotel deals for each registered user depending on the preferences of the user and the type of stay. Nustay differs itself from its competitors – current OTA( Online Travel Agency’s) market actors such as Booking.com and Hotels.com. Nustay combines the best and most important aspects of existing online booking – a large hotel inventory, a great booking experience and lower prices than its competitors. Today the customer can choose personal preferences such as hotels especially suitable for young people, families with children, hotels close to shopping facilities etc. Furthermore, the search for hotels can also be personalized based on a large number of parameters and by data regarding the customers personal interests such as room quality, WiFi quality, pet friendliness, what type of food its restaurants serve etc. But the most important strength and competitive advantage is that Nustay is a non-contracted OTA that have deals with wholesalers, compared to competitors that have deals with the hotels directly. Why is this an advantage you might ask? Well, it works like this. Nustay has wholesalers as suppliers that have contracts with the hotels. So Nustay can choose the supplier that gives the best possible price for the customer. The wholesalers buy in bulk and therefore they can give a better price to Nustay. This is not easy to understand even for me but as shown in the next paragraph Nustay does deliver the best prices in the market for travelers. Furthermore, a central aspect of Nustay’s business model is that customers pay for their hotel rooms when the booking is completed. The Company then does not pay the B2B hotel suppliers until up to 30 days after the guest has checked out. This enables Nustay to have a continuous strong cash flow which finances the Company’s increasing growth and also reduces the Company’s needs for external financing.

I have tried the product and feel very confident about it since it has a very high quality compared to competitors. This year the company will launch an app and a loyalty program and I feel that this will strengthen the product even more. The pricing is very competitive and I have made some test the last couple of weeks and it has come clear to me that they are indeed the cheapest OTA in the market. For example, I made a test by doing searches on google when I searched for hotels in the 10 most visited cities in the US. Nustay was cheapest in five out of ten cities. Then, I made the same tests of the ten most visited cities in Europe. Here, Nustay was cheapest in seven out of ten cities. I have continued to do these tests on a regular basis through a period of one month and the results are convincing. Another finding from my tests is that Nustay targets the most visited cities so far since they are not that visible in smaller cities. This, I experienced when I did some other test by searching for hotels in smaller cities. Even though the company has a limited budget compared to competitors the marketing strategy seems to be very successful so far. To target the most visited cities seems to be the correct strategy. Therefore, I feel confident with the pricing model, packaging, marketing strategy and targeting as well.

**Process **

Another key ingredient for a company to succeed is the process. The process of a firm is the company’s operations and this is the key to ensuring a business’s efficiency and opportunities to scale.

When looking at the business efficiency its to early to say if the company is efficient enough. Here you need to get closer to the firm, almost be inside the organisation to get the feeling of the organisation. So it’s really hard for me as an investor to know if the process is efficient at this moment. The best way is to look at future financial reports. If they can maintain costs with increased revenue and become profitable the process is efficient. If they don’t manage to become profitable when the revenues increase the process is not efficient enough. Concerning the opportunities to scale they are definitely there. The number of new deals with suppliers and competitors like Kayak, Tripadvisor, Hotelscombined etc shows that the company is scaling up. The stats from Alexa and similarweb are also look promising.

Finance and valuation

The market value of Nustay is 133 MDKK at a stock price of 7,3 DKK. In the IPO in March they received approximately 18 MDKK after cost. Then they payed a loan of approximately 3,5MDKK, so they should have around 14 MDKK left. This money could take them to positive operational cashflow already this year, although they say that they will reach it next year. As stated above the company does not pay the B2B hotel suppliers until up to 30 days after the guest has checked out. This enables Nustay to have a continuous strong cash flow as long as they grow. This reduces the company’s needs for external financing.

In the presentation in February the company said that the burn rate was 1,6 MDKK monthly and therefore 4,8MDKK quarterly. So far the gross margins have been around 10%. I think that the gross margins will grow in the future but stay conservative in my expectations at 10%. So if they reach 50 MDKK in turnover in a quarter with a 10% gross margin they could have positive operational cash flow. However, other costs like marketing and personnel costs etc are likely to increase as well so I don’t think they will reach positive operational cash flow with 50MDKK in turnover. If I take increased costs into account I still think they could become profitable this year. I think they can reach a quarterly turnover of 80 MDKK already in q4 this year and if so they could become profitable. My expectations about this turnover in Q4 comes from the company’s own goals to grow at least 10% every month this year. If they don’t reach this they might have to take in more investment capital to to reach positive operational cash flow.

It’s not easy to value a company like Nustay because they are still just in the beginning of their growth face and they are growing very fast. But one has to take into account the deals they have made with Google Hotel Ads, Tripadvisor, Kayak, Hotelscombined and the promising search engine statistics shown above. When I try to compare other companies in the same industry, Bookings for example are valued at 5,6 x sales and Tripadvisor at 4,6 x sales and Expedia 1,6 x sales (https://ycharts.com/companies/BKNG/ps_ratio) and of course they are much larger but they are not growing like Nustay. Another company that can be compared with Nustay is the Russian firm Ostovok that was started nine years ago. Ostrovok is not public and does not disclose it’s figures but there has been a lot written about them in media. By 2014 Ostrovok had attracted 55MUSD in investments and their turnover in 2013 was only 4MUSD. In the summer of 2015, the turnover of the online service was $15 million per month and In 2018 their turnover had grown to 718MUSD(https://en.wikipedia.org/wiki/Ostrovok.ru). Ostrovoks main business is in Russia but they have a European and US focus brand Zenhotels.com and if we compare it to Nustay.com on similarweb, Nustay is gaining on them fast ( https://www.similarweb.com/website/nustay.com?competitors=zenhotels.com ). If Nustay can grow like Ostrovok the stock is bound to tenfold in the next couple of years. With the rapid growth ahead and the industry shifts towards customers using Google Hotel Ads more and more it’s not impossible for them to reach a turnover of 200MDKK per quarter already sometime next year. Looking at this and the valuations of the competitors the company valuation is not at all unlikely to be at 1,5 x forward sales. So if they reach 80MDKK in turnover in the fourth quarter the market value of the company could be 480MDKK ((80x4)x1,5).

Conclusions

The hotel industry is shifting with Google Hotel Ads gaining more and more market share. Only two years ago Google Hotel Ads was a very small player that a few people knew about. Last year Google made its step to the market when they released their Beta of Google Hotel Ads and since then they have been growing rapidly. Nustay is the perfect match for a product like Google Hotel Ads since they are a non-contracted OTA that have deals with the hotel wholesalers. Nustay’s platform has made it possible to connect and re-form the relatively bad data from hotel wholesalers and made it saleable. The company release of the platform came in a perfect timing of Google release of Google Hotel Ads. Nustay has very experienced management and board and the employees are managing the customers in a very professional matter as shown by the high scores on trustpilot. The product is highly adapted for the customers needs and cheaper than its competitors. The company’s platform is scalable since it reaches customers all over the world. It is also gaining more and more interest according to internet search stats. Since the platform is quite new in the market it’s not so well known but this is about to change as shown in the internet search statistics. The 30 day payment solution that Nustay has with its suppliers were they pay 30 days after the traveler has checked out, lowers the risk of cashflow shortage immensely. However, there still is a risk that the company will have to take in more investment money but the growth is so rapid that it should interest investors to buy the stock at the current price anyway. Even though I have a very good sense about Nustay remember to do your own analysis and read more about the company. Below you find a short interview with the CEO and important material to read from the IPO presentation.

Interview with CEO- Mathias Lundoe Nielsen

1.One question about your history as an entrepreneur. You have been involve in two cases of bankrupcies one in 2014 and one in 2016. Can you comment why this happened and in which industry and what you have learnt from it.

Answer: I was working in the fashion industry at the time and had several websites. It was the time when Zalando moved into Scandinavia and started offering both discounts on all products, free shipping and return shipping without limitation on total order amount. They had raised significant funding and were as part of their strategy able to sustain huge losses year after year as part of their expansion strategy.

In fashion you need a large physical stock, which you buy 6 months before the actual season starts. Its risky and means you have a lot of cash bound in the products. Take a look at H&M, it’s a good example. I never really liked fashion, I liked online sales and working with data. The best selling products we ever had was shoes that I designed and manufactured myself. The design was based on data we collected both from our websites but also from third party.

My companies that went bankrupt were not losing money in terms of EBITDA, but because of missing cash flow. It was a couple of very hard years and I learned a lot about myself, crisis management and the importance of being able to adapt as business to new environments immediately if needed. It thought me how to structure a business in order to scale fast, yet still survive if any bad seasons would arise, and it learned me a lot about what not to do.

2. In the presentation from Stockholm you say that the customer shall get the best choice of hotel thats best for the customer, not the hotel that gives you the best provision. But then when CFO shows the slide with 100DKK in marketing gives 500 back in revenue and how to make it 900 back in the future one of the ways is to promote the hotels that gives you more provision. Then it feels like you still will end up like your competitors, like everyone else on the market? Any comments on that?

Answer: What he meant was we promote the suppliers of the hotels that gives us ‘more’, while the hotels stays the same for the users. As we have explained during the IPO presentations, we have 70+ hotel suppliers ,which means we can easily have 30+ suppliers for 1 hotel, and in these situations we through our technology optimize our buying so that we select the suppliers who gives us e.g. marketing contributions, yearly overrides (kick back) and weekly or monthly bonus incentives based on total sales. This increases our commission without Nustay ending up like our competitors.

We buy from hotel suppliers while Expedia buy directly from the hotel. It means that if Expedia optimizes their commission, then it will per default mean they promote hotels which gives them higher commission, and these might not be the best hotels for the users.

As explained in our prospectus, when we buy from both regular OTAs but also b2b hotel suppliers (wholesellers), who’s only business is hotel room distribution, it’s obvious we have other buttons to push in order to get higher commissions, as it’s a different business model.

3. How will you compete against giants like Bookings and Expedia?

Answer: Online hotel booking is a much bigger industry and much more fierce than what many people think. Few companies dominating, with huge financial power.

Many investors have been skeptical in the early days of Nustay, and even today many are skeptical (reflected in the questions I got during the IPO presentations). It seems to me that they are afraid of the power that Booking.com and Expedia have over the hotels.

The thing is, that the skeptics don’t know about companies like Hotelbeds, which we also buy from, even though we make it quite clear in our prospectus. These companies have just as much power over the hotels, and companies like them, wholesalers or suppliers as they are called, don’t work with Booking.com and Expedia. So they cant be pressured by them.

Downside of the wholesalers, as I have said many times in my presentations, is poor data quality and slow response times in the APIs. That combined with rate parity in the industry, seems to have made it enormously difficult for B2C OTA startups to rise in the shadows of Booking and Expedia.

But as written in the prospectus, Nustay has found a technical solution that enables us to create a booking platform that runs primarily on wholesaler rates, providing competitive rates and broad selection - without giving a bad user experience to our customers.

That, combined with the fact that the whole online hotel booking industry is changing due to meta-search being implemented directly in the biggest search engines in the world - Google, Bing, Yahoo and Yandex Hotel Ads – creates a unique opportunity for a company like Nustay. Especially when a giant like Google selects Nustay as the only SMB in the world to be part of their Beta in Google Hotel Ads, and Bing, Yandex and Yahoo selects Nustay to be part of their Alpha of their Hotel Ads products. (all info here part of our IPO presentations).

Even Tripadvisor, which is meta-search not an OTA like Nustay, stated in a recent report/press release that they expected for the first time ever to decline in traffic and that they saw competition from a new Google product (Google Hotel Ads).

Meta-search concepts - websites like Tripadvisor, Trivago etc is going to have a hard time in the very near future.

4. Right now the customer can only pay in Euros. Do you have any plans to change this? My feeling is that for example a US customer wants to pay in USD. Maybe especially the customers traveling in their work.

Answer: Yes, features like this is constantly being added to the website, as part of Nustay V3, which is mentioned in the prospectus. USD payment will be added very soon. Up until now we have been charging in EUR to minimize our risk, I believe our CFO spoke about this in one of the IPO presentations, during the QA after the slides. However, we naturally have found a good solution moving forward to offer payment in several currencies, as part of the growth journey.

5. Concerning your payment deals. You get the money in advance from the customer and pay the hotel 30 days after. Do you have any plans to work with money hedging, meaning securing if the currency drops or goes up during these 30 days?

Answer: As we only have accepted EUR until now, the company’s impact from currency fluctuations is insignificant as all major transactions are done in EUR. Opening up for additional currencies as mentioned above would naturally open up for currency risks. As stated in the annual report, Nustay is currently not using any financial instruments to hedge the risk exposures, but where possible, implementing natural hedges. If considered necessary, the company will implement financial instruments for hedging.

6. Do you have any plans to focus on the customers that travel in their work? I know that you have a loyalty program on the way but anything else ? I feel that this market has a huge potential.

Answer: Concerning customer acquisition, we focus entirely on the B2C market as per our prospectus, as this is an extremely big market and we have a product which has proven to be able to compete directly with companies like Expedia and Booking.com. Huge companies that is. The B2C market is much more lucrative than B2B, if we are able to penetrate it.

With that being said, we have as part of our strategy, and company goals for 2020, established a small B2B distribution division and already closed our first deal a couple of months back, which was announced in a PM, securing Nustay a NET revenue (margin) on minimum about 1,4 MDKK, with an upside if the particular company is able to grow its bookings. B2B distribution (travel tech) is very interesting since it does not inflict us any costs, and we have exceptional good rates and very advanced technology, which makes us a good choice as hotel supplier for other companies – both B2B and B2C. We expect many more deals like this will come, which is of course why it is a company goal for 2020 – it was a surprise for us that we were able to close the first deal so fast, but that just underlines what we have really works.

**7. Do you feel that you have a strong enough offer now when the summer season comes? **

Answer: Yes, I have never been more confident in our product.

8. Also one question that I got from an investor about the loyalty program. Will it not take all your margins since every tenth hotel night will be free?

Answer: Not at all, when you login we are able to sell rooms from API feeds, which we are only allowed to use for logged in customers. Its called Closed User Group feeds. Our margins are high on these feeds so even with if there was applied an extra 10% discount, our margins would stay at the forecasted level. We give 1 night free after 9 night booked, hotels.com give 1 night free after 10 nights booked, so we will even beat them there.

Also remember we at Nustay see ourselves as a tech company and not as a classic travel agency, as stated in our prospectus. Due to this, our setup is much more lean than the employee heavy Expedia and Booking.com that are classic online travel agencies, e.g. with thousands and thousands of ‘hotel contractors’ all over the world.

We believe Nustay’s tech focused model allows Nustay to work with lower commission than competitors.

Important material to read: