Opening statement

Monsanto Company have outper- formed the S&P 500 historically, in this commentary I’ll focus on technical factors using Monsanto Company’s 2013 annual report as the source. The purpose is to analyse and make a clear investment recommendation on the stock. My recommenda- tion will be based on historic statistics and forward-looking statements.

Analysis

Internal factors

Monsanto often points to population growth in their commen- tary as a main driver for increased business. This statement re- flects net sales well. In their annual report net sales have incre- ased from 2012 to 2013. This reflects their dividend as shown below:

Dividends per Share

Year 2nd Quarter 4th Quarter Fiscal Year

2013 $ 0.75(1) $ 0.81(1) $ 1.56

2012 $ 0.60(2) $ 0.68(2) $ 1.28

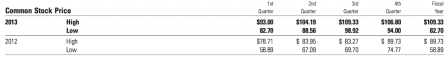

Dividend is a clear driver of the stock price and an increased dividend drives up the P/E ratio which I will calculate after looking at the common stock price. It is to be noted that the board of directors in June of 2012 authorised a 3 year repurcha- se program of up to $1 billion of the company’s common stock. What is interesting here is if the repurchase program might have created artificial demand, driving the stock price higher than what is reasonable. To gain knowledge in this matter we must first take a look at the stock price as shown below:

Thus we get some interesting P/E ratios for the high and low points of 2012 and 2013 as a fiscal year.

2012 P/E

High 70,1

Low 46,0

2013 P/E

High 70,1

Low 53,0

As the P/E ratio shows the buy-back program has not affected stock valuation in an unreasonable way. An explanation for the high P/E ratio can be found in some of the company’s forward looking statements about development but there is also raw numbers in the annual report that show Monsanto’s eagerness to continue increasing their market share and develop new profitable pro- ducts. If we take a look at Monsanto’s R&D costs it becomes clearer. Monsanto’s expenses for research and development (R&D) were $1,533 million in 2013, $1,517 million in 2012 and $1,386 million in 2011. The increase in R&D costs can be traced back to the development of new seeds. Yield potential is impor- tant because the world population is expected to reach 9.6 billion people by 2050. If Monsanto is able to harness the future crop market then their valua- tion is more than fair. From a perspective of aiming

towards anticipating future trends than Monsanto could very well be a future powerhouse with a cash cow type of business in 2050.

External factors

When it comes to competition Monsanto mentions that many companies engage in research and development of plant biote- chnology and breeding and agricultural chemicals, and speed in getting a new product to market can be a significant competiti- ve advantage. With this in mind the speed of which Monsanto delivers their products to the market can be crucial for the company’s future success. They also expect to see increasing competition from agricultural biotechnology firms and from major agrochemical and seed companies. Thus Monsanto choo- ses to spend a large section of their annual report to comment on how they protect their intellectual property, such as patents, however I do not find this to be a necessary focus when it comes to making an investment decision. Money talks and bullshit takes the bus, Monsanto’s R&D spending is something that local competition cannot keep up with in the long run. And with a strong presence in the agricultural parts of the world, especially South America, I see an already globalised firm which will continue to squeeze competition out of the market. With fewer competitors Monsanto will have the ability to raise prices and thus increase profits.

Executive summary

Looking at the development from 2013 to now it is clear that the highs are getting higher and the lows are also getting hig- her. This is fair given the increase in revenue from 2013 which can be paid out as dividends in 2014. If sales continue on this path then Monsanto is looking very attractive indeed. The chi- ef executive officer, Hugh Grant, of Monsanto comments that Monsanto is providing healthy and nutritious food for a popu- lation that is expected to grow from 7 billion today to nearly 10 billion by 2050. With clear statements of a growing market and with increasing revenue Monsanto can currently be classified as a star according to the BCG box. In 2050, however, this will most likely change towards being a cash cow. I believe that Monsanto will be able to continue to grow, thereafter it will be easy to divest and harvest from a stable and mature market. Recommendation is a strong buy.

*Commentary restricted to annual report of 2013, forward looking statements and do not reflect ethics and/or downside risk.